.

During the presidential debate for Bartlett’s reelection in The West Wing, the Democratic president turns to the Republican nominee and says:

“There are times when we’re fifty states and there are times when we’re one country, and have national needs. And the way I know this is that Florida

didn’t fight Germany in World War II or establish civil rights. You think states should do the governing wall-to-wall. That’s a perfectly valid opinion. But your state of Florida got $12.6 billion in federal money last year – from Nebraskans, and Virginians, and New Yorkers, and Alaskans, with their Eskimo poetry. 12.6 out of a state budget of $50 billion. I’m supposed to be using this time for a question, so here it is: Can we have it back, please?”

Like Governor Ritchie and the Republicans in the West Wing, real-life Republicans and Tea Partyers abhor big government. But as President Bartlett pointed out, we do not operate as a collection of states, and the federal government gives considerable aid to the various states to supplement state funding. This is inevitably a redistribution from wealthier states to poorer states–from Wall St. and Silicon Valley to Main St. and Tin Pan Alley. But the latter is not so grateful for the assistance of the former, and even as they accept federal dollars, Republicans vilify the source of their extra income.

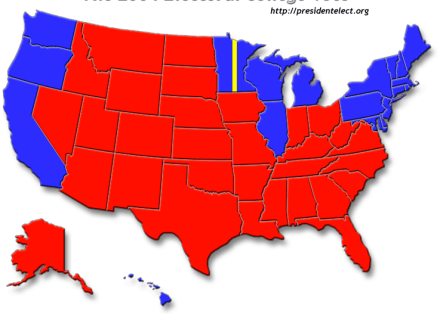

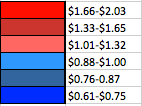

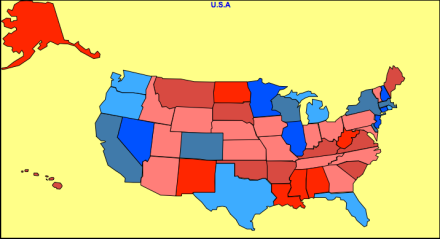

Above we see two maps of the United States. The one on the bottom is a familiar Electoral Map from Bush v. Kerry, 2004. On the top is a map I created (alas, I could not find a snazzier map-making program) using data from the Tax Foundation. It shows Federal Dollars Received by State Per Dollar Sent to Washington. Notice anything? To a large extent, the red states correlate from map to map. That is, Republican states in favor of smaller government were actually the biggest beneficiaries of big government. For every dollar Mississippi sent to the federal government, it received $2.02; for every dollar New Jersey sent to the federal government, it saw only $0.61. Yet Mississippi voters don’t berate their Senators and Representatives for being so effective at bringing home the bacon. In Mississippi, the 2007 budget was composed of $8.4 billion from state-source funds, and $5.9 billion from federal funds. Over 40% of Mississippi’s state budget that year came from the federal government, and of that over half came from out-of-state taxpayers, including liberal elites in places like New Jersey, New York, and Connecticut. Can we have it back please? (funnily enough, Gov. Ritchie’s Florida just about breaks even at $0.97 received per dollar sent. The other odd blue state, Texas, is also close at $0.94.)

The other irony is that, living in D.C., I see license plates every day that complain “Taxation Without Representation”, and lawn signs campaigning for DC Voting Rights. Yet although New Mexico and Mississippi have the highest returns of any states, the District of Columbia blows them out of the water. For every dollar D.C. sent to the Treasury, the federal government paid $5.55 back. For that kind of money, I’d happily trade the services of my representative, Scott Garrett from the NJ-5th.

Full rankings of federal funding below the fold:

| State | Federal Spending per Dollar of Federal Taxes |

| New Mexico | $2.03 |

| Mississippi | $2.02 |

| Alaska | $1.84 |

| Louisiana | $1.78 |

| West Virginia | $1.76 |

| North Dakota | $1.68 |

| Alabama | $1.66 |

| South Dakota | $1.53 |

| Kentucky | $1.51 |

| Virginia | $1.51 |

| Montana | $1.47 |

| Hawaii | $1.44 |

| Maine | $1.41 |

| Arkansas | $1.41 |

| Oklahoma | $1.36 |

| South Carolina | $1.35 |

| Missouri | $1.32 |

| Maryland | $1.30 |

| Tennessee | $1.27 |

| Idaho | $1.21 |

| Arizona | $1.19 |

| Kansas | $1.12 |

| Wyoming | $1.11 |

| Iowa | $1.10 |

| Nebraska | $1.10 |

| Vermont | $1.08 |

| North Carolina | $1.08 |

| Pennsylvania | $1.07 |

| Utah | $1.07 |

| Indiana | $1.05 |

| Ohio | $1.05 |

| Georgia | $1.01 |

| Rhode Island | $1.00 |

| Florida | $0.97 |

| Texas | $0.94 |

| Oregon | $0.93 |

| Michigan | $0.92 |

| Washington | $0.88 |

| Wisconsin | $0.86 |

| Massachusetts | $0.82 |

| Colorado | $0.81 |

| New York | $0.79 |

| California | $0.78 |

| Delaware | $0.77 |

| Illinois | $0.75 |

| Minnesota | $0.72 |

| New Hampshire | $0.71 |

| Connecticut | $0.69 |

| Nevada | $0.65 |

| New Jersey | $0.61 |

| District of Columbia | $5.55 |

Very interesting. How do you measure federal spending.

I’ve seen alot of this “studies” and frankly from looking at them or more to the point the complete lack of anything to look at as far as the “study” goes… they are bogus.

As far as I can tell they simply take direct federal spending and match it up vs the federal taxes. This is of course a total joke of a study. First many mid western states have large military bases which exist because they need massive amounts of space for training. They don’t have massive arty ranges or tanks training areas in places like NJ because the land costs so much and due to the population(though they did when both were lower). Military bases along with other things to include massive federal parks such as I believe Utah has something like 40% of its land in some sort of federal hold get federal dollars to maintain federal land, this along with countless or land management such as indian reservations. Then you add in that many mid west states have much smaller populations this makes it look like they are getting a larger slice of the pie when in reality much of the federal money in fact goes to federal projects that the state may not even want. Add in again you have something like social security, medicare host of other “old” programs… where does the “old” go… FL, NM, AZ, host of the warmer cheaper places to live.

Until someone can break these numbers down into exactly whats counts as federal money to the “state” these studies seem purely designed to be propaganda.

federal money is money that comes out of my pocket in a liberal blue state to pay for a military base in your state that creates jobs and local revenue. If you dont want the base (and the jobs you say the government doesn’t create) send them packing. Federal money also pays to offset what you Christian red staters won’t do yourselves: feed the hungry, shelter the homeless, treat the sick. BTW, the argument about military bases and retirees would be good one if you leave out California which has more retirees and miltary bases than NM, AZ, and FL combined and still sends the Fed more than it gets back.

EvilAL, I’m from Utah. Are you proposing that we get rid of Hill Air Force Base, all the federal parks, etc? And that Utah is then exempt from the VAST majority of federal taxation (i.e. taxation beyond defense, and other very limited functions), federal regulation and intrusion?

Done! Sign me up now!

Okay. So the western states have large percentages owned by the feds. Okay, that is obvious.

So, how do you explain California and Nevada.

45.3 % of California is owned by the Feds

and 84.5 % of Nevada is owned by the Feds.

And you leave Florida alone. They pay more than they receive.

Douche nozzle!

SS, federal projects, military spending by federal government does not go into state budgets.

This study is also invalidated by modern factors (such as the oil boom in the Dakotas that have reversed their situation to where they’re donor states now).

Federal military bases , lands, forest etc.. do not pay taxes into federal government. The spinding by federal government on these things do not go into the state budgets.

Yes, and D.C. is $5.55. Spare us the lecture about how central planners “give” anyone anything, alright? I would prefer the central government quit meddling and do what it is supposed to do: preserve law and order and defend the country, and that is it.

Well technically the government is required to “establish Justice, insure domestic Tranquility, provide for the common defence[sic], promote the general Welfare, and secure the Blessings of Liberty…”. So a little more than what you said there.

Pingback: 2011 in Review | stone soup

Pingback: Civil war possible if Obama reelected - Page 16

Pingback: Mitt Romney For President! | Harry Ramble's E-Z Epiphany Dispenser

Pingback: Mississippi wants power to negate federal laws. Ummm… | Outspoken

Pingback: Conservative Governors? | The Right Side Blog

I’m curious as to the source of your 50 state (+DC) list. Perhaps more importantly – because I may blog on a related issue – has the data been updated with 2015 or 2016 YTD figures?